Bitgrail Please Try Again Later Verification

What a ride. Permit's non practise that again.

BitGrail never had an peculiarly skilful reputation. Even earlier a massive theft put the exchange nether, its operator Francesco "The Bomber" Firano was often defendant of lacking both the technical competence and the wisdom to virtually-single-handedly run a cryptocurrency exchange.

Every bit authorities trawled through a mountain of evidence following the incident, they plant ample testify to support these accusations.

The outcome has been settled now, with BitGrail as a business organization and Firano personally being declared bankrupt and ordered to pay dorsum customers as much equally possible.

The resulting saga left an enduring banner on cryptocurrency in the form of an emerging legal precedent and an absolutely incredible example of what not to do if yous're running an exchange.

Bad decisions, decisions

Bitgrail had almost accidentally put itself in the position of being i of Italia's just cryptocurrency exchanges, and one of the only places to merchandise Nano, during 2017 when cryptocurrency in full general and Nano in item were booming in popularity.

So well-nigh by accident, Firano had chop-chop gone from running a scrappy trading venue for a scattering of Italian bitcoin enthusiasts, to running a scrappy trading venue for hundreds of millions of dollars in digital avails from customers around the earth. All exchanges at the time had the same experience, just navigated it with widely varying degrees of grace.

With the case now settled and lots of muddy details aired, it'south at present possible to look back at the unabridged incident from start to finish, and really marvel at some of the incredibly bad decisions made forth the style.

First mistake: Not reading the transmission

The thieves took advantage of an oversight on BitGrail which allowed people to withdraw more funds than they should have been able to.

Basically, information technology was possible to request multiple withdrawals from BitGrail, and it would make information technology so. The theft was literally merely someone making the same withdrawal asking multiple times on Bitgrail, at which point Bitgrail would tell the blockchain to send multiple withdrawals to that person. BitGrail failed to implement "idempotency" equally the lingo goes.

The need to implement idempotent transactions for Nano was known at the time. It wasn't some kind of newly discovered vulnerability. Firano didn't feel the need to thoroughly read the available documentation or engage with developers when adding Nano to BitGrail.

Just slap it in there, it'due south probably fine. What's the worst that could happen?

2d mistake: Ignore the trouble

The Nano was stolen from BitGrail between July and Dec 2017. The first batch of Nano went missing in belatedly July 2017, and as the court noted, Firano was aware of the loss nearly every bit presently as it happened.

He made a blasé note of the effect on Twitter, saying he closed the perpetrators' accounts.

two.5 one thousand thousand Nano went missing in that first batch, and although prices were much lower then (nearly US$0.05 each) it was even so worth $125,000 at the time, and probably qualifies every bit a piddling more than an "attempted" scam.

Tertiary mistake: Go along ignoring the problem

At this signal most people would realise that closing people'due south accounts doesn't do anything to really set the vulnerability and would desire to do something virtually that rather than keep leaking money.

Firano is non well-nigh people.

The next big loss was 7.5 million Nano that went missing in Oct 2017, worth somewhere near $one million at the fourth dimension.

Despite the worries that must have been starting to niggle at this indicate, he yet took no meaningful action.

Fourth mistake: Wow

Nano prices went basics shortly subsequently the 2d loss.

- It topped US$1 each on 10 December – the commencement 2 bouts of lost Nano were at present worth $x million, and notwithstanding no one had any idea that information technology was missing from the exchange.

- It bankrupt $five on 21 December. That stolen Nano was at present worth $50 million.

- It shot past both $10 and $xv within a 24 hour menstruation on 29 December. That's $150 1000000 lost now. Human being, Firano'southward customers are gonna be pissed.

Nano prices eventually peaked at about $37 before they started declining with the balance of the cryptocurrency markets. The entire time, BitGrail remained one of the only places to trade Nano, and its exorbitant rising was undoubtedly good for business.

Unfortunately the vulnerability was still out there, new people were coming to BitGrail to hunt Nano every day, and no one knew that hundreds of millions in cryptocurrency were missing from behind the scenes. The rising prices coupled with the vulnerability saw millions more Nano disappearing during these heady days, and the thefts continued right upwardly until BitGrail stopped deposits entirely.

So, what happens when people try to greenbacks out their winnings?

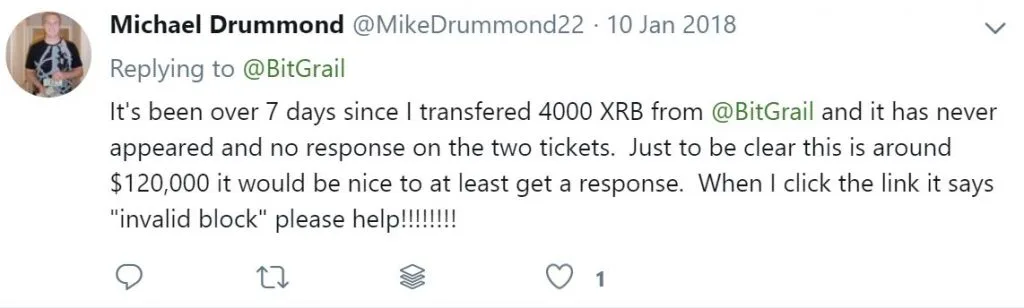

Something like this:

Fifth mistake: Nothing to come across hither, motion forth

So, people are all trying to greenbacks out hundreds of millions of dollars of cryptocurrency that y'all don't have. You need to stem the outflow, but have to play it cool and brand information technology look similar nothing's wrong. Firano did this first by converting the main exchange hot wallet to a common cold wallet and switching off withdrawals for large periods of fourth dimension in the procedure.

And 2nd, past instituting a sudden tour of apparent AML/KYC measures. Under the sudden changes all Euro-based traders would have to get verified, and all non-Euro traders would have two weeks to get their funds off the substitution, which could only be washed past converting to BTC – no Nano withdrawals immune. The kicker is he besides capped daily withdrawal limits, which prevented a lot of people from getting their funds off the exchange inside the time limit.

This caused Nano prices to plummet and bitcoin prices to rise sharply on the exchange, which may have bought some more than breathing room.

Sixth mistake: Bail and shift the blame

Firano released a public statement on 9 Feb announcing a "shortfall" of 17 million Nano. Only he was quite decorated before then.

Nano withdrawals were closed for the concluding time on 28 January, leaving thousands of people with on-newspaper money trapped in the substitution. A calendar week later, Firano started cashing out bitcoin, in the class of a 230 BTC deposit at some other exchange, which he then moved to convert to cold difficult greenbacks through a linked bitcoin ATM.

And the day before the big reveal, he was in talks with the Nano team.

"I need to report this lost to the police ASAP," - Firano, literally 6 months and 16 days after offset discovering the loss

The conversation log is well worth a read with full knowledge of what happened. Amongst other statements that have aged poorly, highlights of the conversation log of Firano's talk with the Nano team shows:

- The thefts connected right upwardly until Jan.

- Firano was fishing for a style to avoid admitting that he knew about the vulnerability for over half a year.

- In the end, Firano owed his users 19 one thousand thousand Nano and had only 4 million left.

- The switch from hot wallet to cold, and disabling of withdrawals seem to have been misguided efforts to prevent the funds from disappearing.

"Nosotros can't expect and nosotros need to exist 100% transparent on it," - Firano, a guy who's all almost timeliness and transparency.

In the end, Firano decided to try to shift the blame onto Nano. He asked for a recovery fork, said that he would be blaming Nano if they didn't agree, and the residue is history.

Everything else

Firano wasn't washed though, and in the post-obit months he would punctuate circumstances with a few more head-scratchers.

- Feb: Firano polled users to ask whether BitGrail should re-open up or declare bankruptcy. Most 80% said to declare bankruptcy. Firano says screw information technology, and made plans to reopen anyway.

- March: He floats an option to afflicted users where they could get reimbursed twenty% of their lost Nano, and get the remainder in "BitGrail shares" which would be bought back over time. In plow, users would have to agree not to sue him. Information technology wasn't popular.

- April: A course action lawsuit against BitGrail gains steam, funded past donations. Nano developers concur to friction match user donations to take on BitGrail. Firano probably shouldn't have ticked them off.

- May: BitGrail re-opens for literally hours earlier endmost again when a Florence court says something similar "seriously? No. Switch that thing off".

- June: Courts take BitGrail funds from Firano's possession, figuring he can't be trusted with them.

Today

The case has concluded, with remaining BitGrail assets being used to compensate affected customers where possible. Beyond that, the courts have found that Firano's conduct throughout the entire ordeal directly contributed to a loss of user funds, and that he is personally responsible for some of the losses.

As such he's too been pushed into bankruptcy and forced into liquidation to compensate users.

One of the more than lasting implications of the case, in Italy at least, is the finding that cryptocurrency exchanges exercise have some kind of obligation to protect customer funds. It sounds obvious, merely there are however a lot of expressionless zones where crypto exchanges can scrub their hands of client losses where any other fiscal institution would exist liable.

Disclosure: At the time of writing the author holds ETH.

Disclaimer: This data should non be interpreted as an endorsement of cryptocurrency or whatsoever specific provider, service or offering. It is non a recommendation to merchandise. Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Operation is unpredictable and past functioning is no guarantee of hereafter performance. Consider your own circumstances, and obtain your own advice, before relying on this data. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any determination. Finder, or the writer, may have holdings in the cryptocurrencies discussed.

Latest cryptocurrency news

- Ethereum's toll could dip to AUD$2,150 in the near term, research suggests

- Bitcoin reclaims AUD$43.5k support but volatility means a further drop still possible

- Ethereum drops to AUD$2,500 post-obit Terra wipe-out

- Bitcoin price dips to 10-month low as volatility rules

- What to practise if you own crypto correct now

Movie: Shutterstock

Source: https://www.finder.com.au/the-nano-bitgrail-saga-is-now-over-and-its-changed-cryptocurrency

0 Response to "Bitgrail Please Try Again Later Verification"

Post a Comment